geothermal tax credit canada

Geothermal Heating Systems for Homes Domestic Geothermal heating systems can be a great way to heat a home replace a furnace and are labeled as money savers. The federal government has indicated that direct proceeds from the carbon pricing program will be returned to Ontario residents through a tax-free climate action incentive CAI payment.

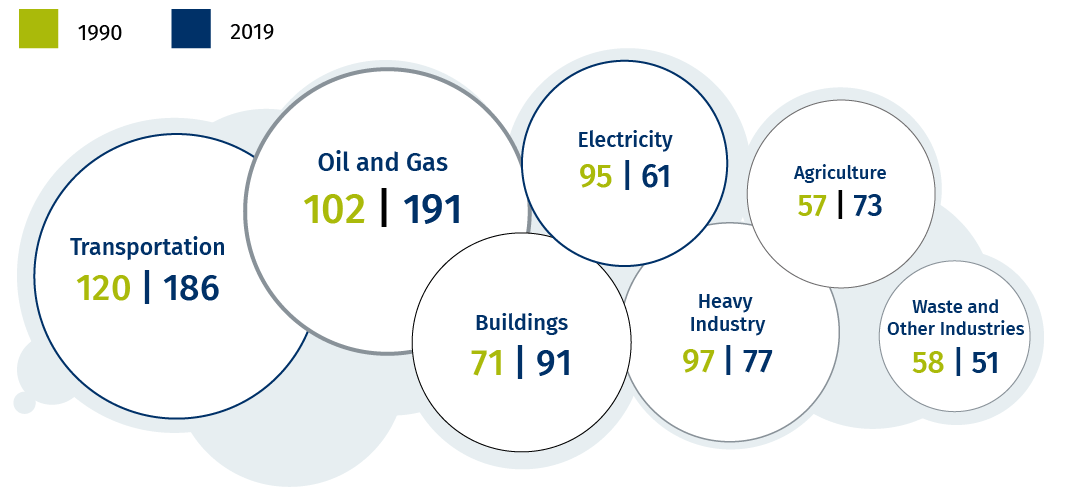

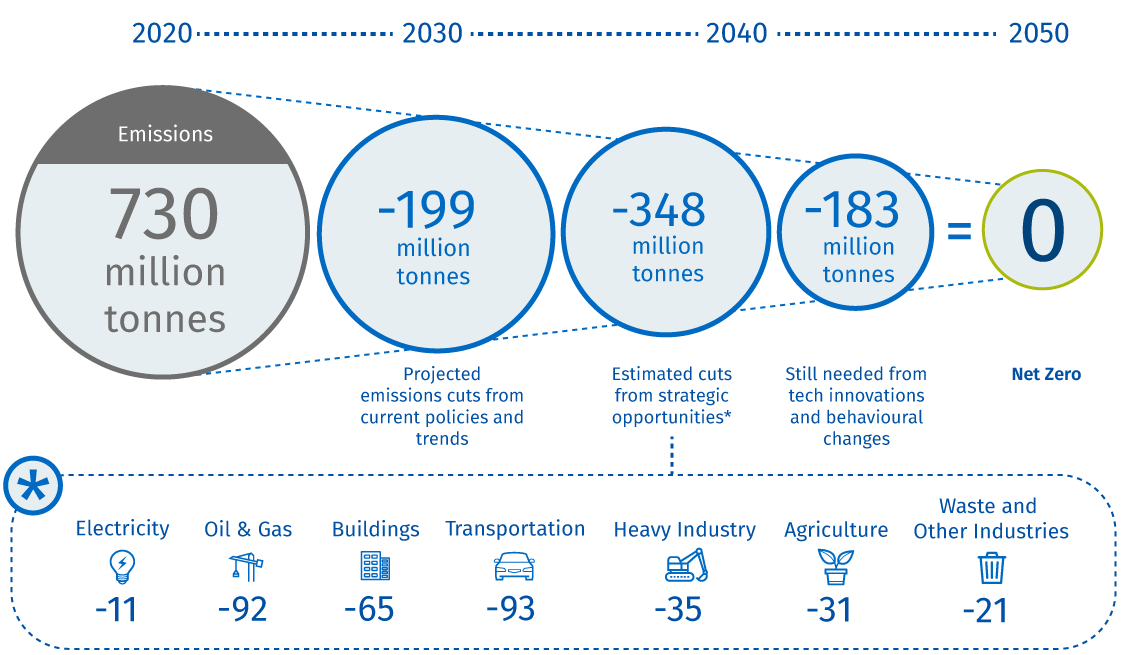

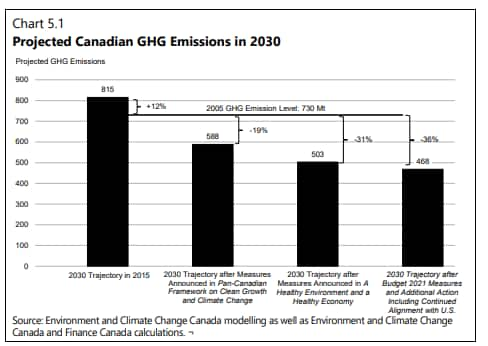

The 2 Trillion Transition Canada S Road To Net Zero

Using an inflation-adjustment factor of 17593 the notice as corrected provides that the PTC for electricity produced from wind as well as closed-loop biomass and geothermal energy increased from 25 cents per kilowatt hour kWh for 2021 to 26 cents per kWh for 2022 rather than 27 cents per kWh as originally published.

. In ways of affordability long term stability and minimal enviromental. There is no upper limit on the amount of the credit for solar wind and geothermal equipment. The Bank of Canada took another aggressive step in its hiking cycle raising its policy interest rate by 50 basis points for a second straight time and warning that it may act more forcefully if.

The federal government has proposed to change the delivery of CAI payments starting July 2022 from a refundable credit claimed annually on income tax returns. Given the countrys high solar potential the solar energys contribution to the. The maximum tax credit for fuel cells is 500 for each half-kilowatt of power capacity or 1000 for each kilowatt.

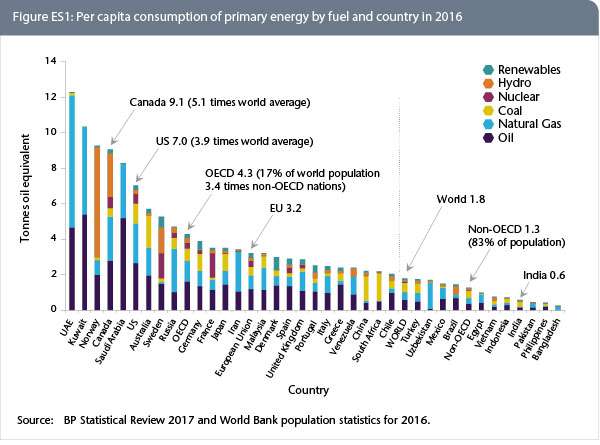

In addition to providing the basic tax implications for business operations in the United States we share our observations regarding the tax consequences for US operations of global businesses. Bank of Canada hikes half a point to 15 warns of more moves. The Philippines receives over 7kWh per square meter per day during its peak month of April and lowest at 3kWH per square meter per day during its off-peak month of December as observed by Schadow1 Expeditions in 33 cities of the country.

In 2015 three solar farms were constructed in the Philippines. For example a fuel cell with a 5 kW capacity would qualify for 5 x 1000 5000 tax credit. The Doing business in the United States guide provides newly enacted US tax law descriptions provisions updates to prior law and some practical insights for Federal tax issues.

If we are to continue with the carbon tax investments made into developing better geo thermal technology.

Taking On An Audacious National Retrofit Mission Would Enable Canada To Upgrade Every Build Heat Pump Installation Renewable Energy Resources Energy Retrofit

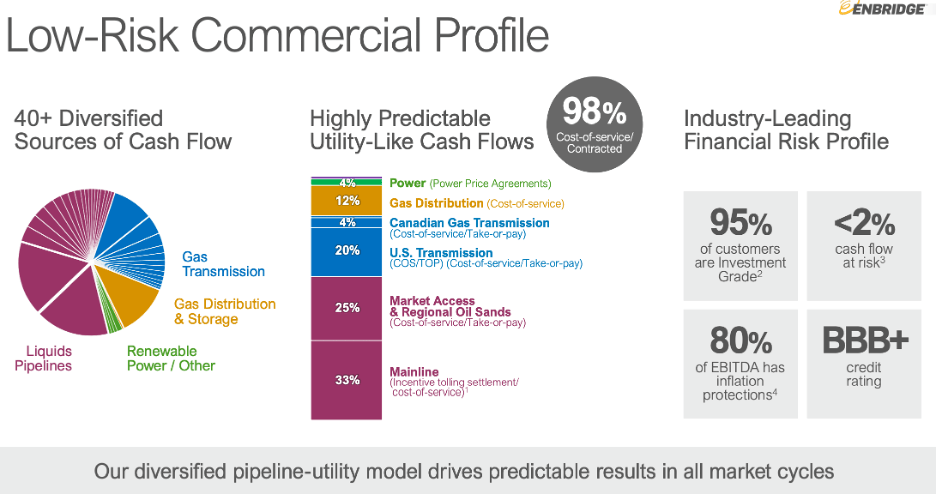

Enbridge Stock The Safest Energy Company Canada Has To Offer Nyse Enb Seeking Alpha

State Of Esg In Canada Esg Enterprise

Ohio Jess Ohio Map Ohio Fremont Ohio

The 2 Trillion Transition Canada S Road To Net Zero

Canada S Budget 2022 Calls For C 3 8b To Launch Critical Minerals Strategy Green Car Congress

Canada Greener Homes Grant 2021 How To Apply Step By Step Ecohome

August 4 2021 If You Re Debating Adding Solar Panels To Your Business Or Home You Ve Probably Heard Solar Energy For Home Solar Power House Residential Solar

Cer Provides Narrow View Of Canada S Oil Production Future

Minnesota Google Images Minnesota State Minnesota Moorhead Minnesota

Canada S Fy2021 22 Budget Includes Big Green Investments Indication Of Additional Ghg Emissions Cuts Ihs Markit

The Federal Geothermal Tax Credit Your Questions Answered

A Supreme Court Ruling Affirming Canada S Carbon Tax Opens The Door For A Startup Explosion Techcrunch

Canada S Fy2021 22 Budget Includes Big Green Investments Indication Of Additional Ghg Emissions Cuts Ihs Markit

See How Employers Are Tapping Into Other Talent Pools To Fill Positions And How You May Be Able To Transition Eas Employee Management Job Search Career Success

Incentives Grants Geosmart Energy

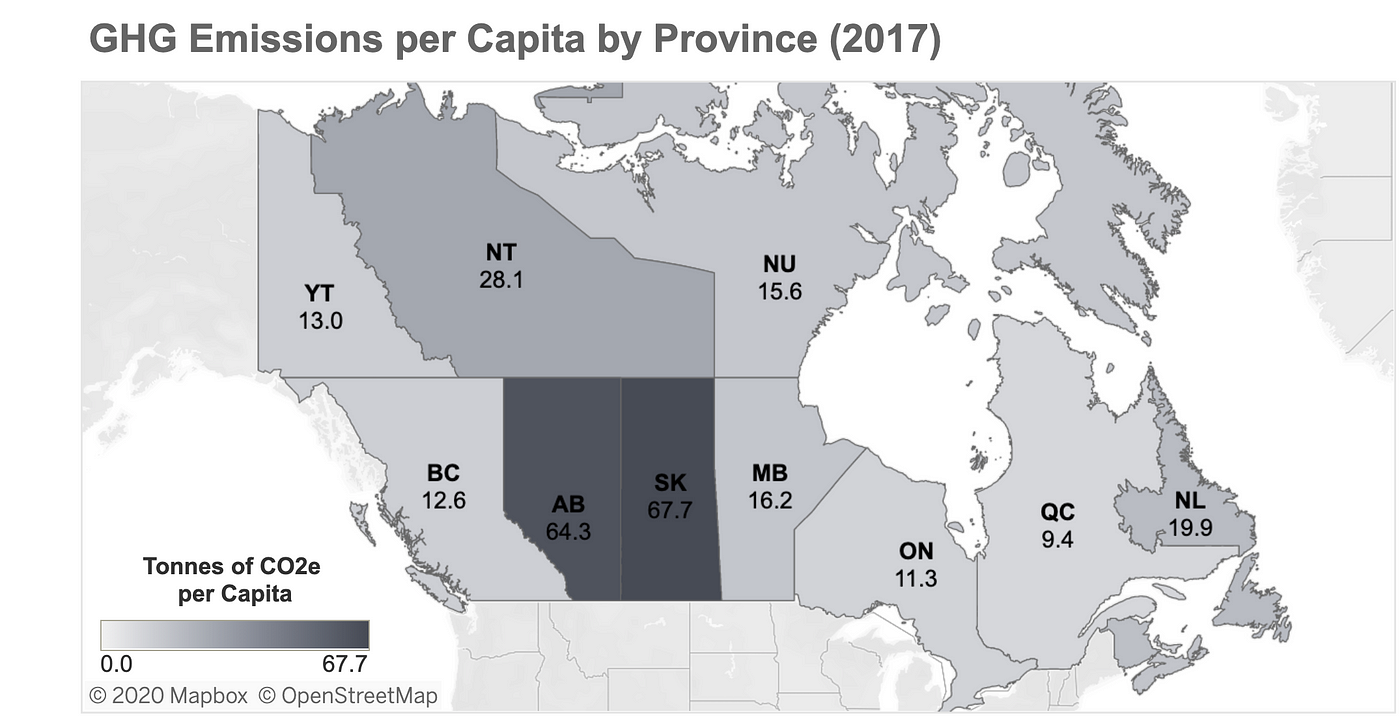

Even Oil Country Will Respond To A Price On Carbon By Michael Barnard The Future Is Electric Medium